Curtain Brand Cold Start Project

Industry: Home Building Materials Challenge: New brand with zero market foundation Solution: Xiaohongshu seeding + Google SEO + Influencer Marketing Results: Break-even in first month, monthly sales exceeded ¥500,000 within 6 months

Fashion Brand Independent Website GMV Growth

Industry: Fashion Apparel Challenge: Low independent website traffic, low conversion rate Solution: Google Ads + Facebook precision advertising + CRO conversion optimization Results: 5x independent website GMV growth in 3 months, advertising ROAS of 4.2

C+B Home Brand Globalization

Industry: Home Furnishings Challenge: Low brand awareness, difficulty managing multi-channel operations Solution: Independent website + Amazon dual-engine, TikTok + Instagram social matrix Results: Annual GMV exceeded $3 million, brand social media followers grew to 500,000+

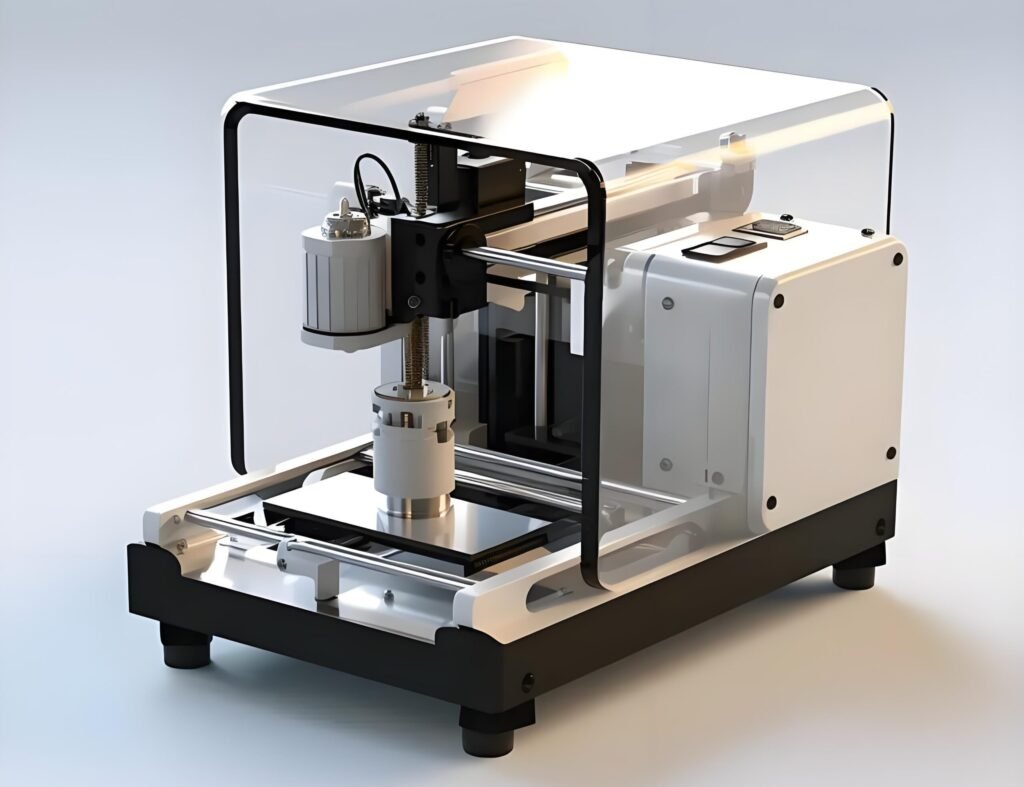

B2B 3D Printing Equipment Export

Industry: Industrial Equipment Manufacturing Challenge: High cost of traditional trade show lead generation, low quality of online inquiries Solution: Google SEO + LinkedIn Precision Advertising + Customs Data Mining Results: 320+ high-quality leads in 6 months, 40% increase in conversion rate

Tax impacts of lease accounting change-5

HMRC has identified several issues which should be addressed in conjunction with such a proposal, including: Can HMRC trust companies to use ‘sensible’ depreciation policies or will there need to be legislation for it? In order to avoid distorting the ‘lease or buy’ decision, the government may be willing to offer an enhanced deduction to […]

Tax impacts of lease accounting change-4

HMRC has identified several issues which should be addressed in conjunction with such a proposal, including: Can HMRC trust companies to use ‘sensible’ depreciation policies or will there need to be legislation for it? In order to avoid distorting the ‘lease or buy’ decision, the government may be willing to offer an enhanced deduction to […]

Tax impacts of lease accounting change-3

HMRC has identified several issues which should be addressed in conjunction with such a proposal, including: Can HMRC trust companies to use ‘sensible’ depreciation policies or will there need to be legislation for it? In order to avoid distorting the ‘lease or buy’ decision, the government may be willing to offer an enhanced deduction to […]

Tax impacts of lease accounting change-2

HMRC has identified several issues which should be addressed in conjunction with such a proposal, including: Can HMRC trust companies to use ‘sensible’ depreciation policies or will there need to be legislation for it? In order to avoid distorting the ‘lease or buy’ decision, the government may be willing to offer an enhanced deduction to […]

Tax impacts of lease accounting change

HMRC has identified several issues which should be addressed in conjunction with such a proposal, including: Can HMRC trust companies to use ‘sensible’ depreciation policies or will there need to be legislation for it? In order to avoid distorting the ‘lease or buy’ decision, the government may be willing to offer an enhanced deduction to […]